The previous post, Financial House I, focused on income, education, and good habits. This article will focus on outflows, or expenses, that can have profound impact. The principles of education and good habits certainly apply to this post as well.

This blog post is the second part of a series:

- Financial House I – Income Fundamentals

- ⇒ Financial House II – Expenses and Management

- Financial House III – Finances for Emergencies

Expenses

Gross Income – Expenses = Net Income

It is easy to spend money. Really easy. Each time money leaves your wallet or bank account, it is called an expense. Generally speaking, the more expenses you have, the greater the income required to stay financially afloat.

“Too many people spend money they haven’t earned, to buy things they don’t want, to impress people they don’t like.”

Will Smith

Unless you are already very wealthy, it is critical to keep track of your expenses (more on this later). Generally speaking, it may help to think about your expenses in the following three categories:

| Rent | Job loss | Impulse purchases |

| Utilities | Flat tire | Unused purchases |

| Food | Appliance failure | ‘Pay later’ purchases |

| Insurance | Injury | |

| Paying debts | Disaster / emergency |

Recurring expenses are the most desirable, since they can be anticipated and accounted for ahead of time.

Unexpected expenses are those that a ‘rainy day’ fund or emergency fund is built to address. Your refrigerator breaking down and spoiling all your food is certainly unwanted, but it may happen when you least expect it.

Unnoticed expenses are hidden from the mind and are the least desirable, most difficult to address, and compound if they are repeated over time. If you buy a $5 cup of coffee for 5 days a week, that translates to $1,300 a year. This ‘small’ expense can really add up year-over-year, especially if you are unaware of its true cost.

Prioritize Where Your Money Goes

Take charge of your expenses. You can do this by mastering these two core concepts:

- Track and be disciplined about your expenses

- Budget

To be financially disciplined with your expenses means being deliberate with everything you purchase. By budgeting, you set priorities and limits to your spending.

Having a budget without tracking your expenses is meaningless, and tracking your expenses without a budget is equally meaningless.

Tracking Your Expenses (and Income)

Why track your expenses? When it comes to budgeting, your actual (tracked) expenditures can be compared to your budgeted allowance and will help you when answering these questions:

- Did I meet my goal

- Did I exceed my limit?

- How are my expenses trending?

Tracking your expenses has never been easier. There are many financial apps that help in that task. You may also use desktop/laptop financial software that aggregates all your accounts into one place. Even using MS Excel will do the trick, but requires more manual work.

Here is a ‘Best financial tracker apps’ article that comes highly recommended.

Tracking expenses becomes more critical if you are a contractor. You may reduce your tax liability significantly by deducting your expenses. If you don’t track them, you won’t deduct them. Expenses may have more than one form, such as mileage.

The same logic applies to tracking your income. Even if you made cash on the side, track it as part of your overall budgeting discipline.

Budget

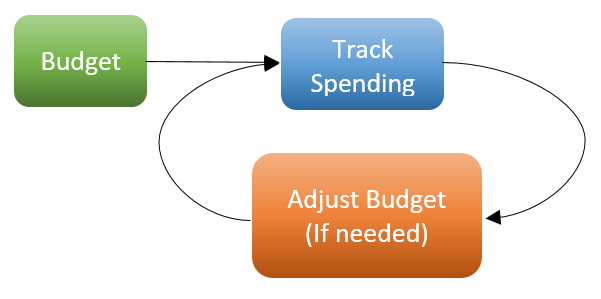

A budget is a way to prioritize your monetary expenditures prior to spending your money. It is used to define where a limited resource (money) should get allocated near and long-term. Before going further, understand that successful budgeting is not a one-time deal, but rather a continuous loop which consists of:

There are many websites and apps that help you form and track your budget. Here is an article with some interesting suggestions.

When forming your budget, it is helpful to think in terms of percentages, not absolute money amounts. For example, If you make $4,000 per month (after tax), your budgeting mindset should say “I will save 30% of my wage.” This way, if you get a raise, the actual amount of money saved will increase along with the raise.

One way to view a personal finance budget is by categorizing monetary priorities into tiers.

Tier 1 – Necessities

A necessity is something that you need for the basics of life and simple comfort.

- Shelter

- Food & water

- Basic clothing

- Transportation (especially to your job)

- Health expenses

- Basic insurance

- Creditors ∆

These essentials get the highest priority when it comes to budget. This means that you pay your rent before you pay for a diamond necklace.

∆ Although paying off creditors is not a true basic necessity for life, it is very important for these reasons:

- It affects your future reputation / credit

- Failure to pay a loan, especially in the form of a credit card, will accrue additional costs such as fines, interest, and other penalties

“If you think nobody cares if you’re alive, try missing a couple of car payments.”

Earl Wilson

Tier 2 – Forward-Facing

After all Tier 1 expenses are taken care of, begin to budget your money towards your future.

- Rainy-day / emergency fund

- Disaster preparedness fund

- Retirement

- Savings

- Other Investments

- College savings

- Secondary business

The earlier you start to invest or save for your future, the better. Compounding interest works to your advantage only if you start early, so your funds have enough time to grow.

Tier 3 – Discretionary

After all the expenses of Tier 1 and Tier 2 are taken care of, the remainder of your paycheck may be treated as discretionary. This does not mean you must spend every remaining penny, but go have fun and enjoy life now. If you didn’t spend all your discretionary money, save or invest it.

Adjustments

From time to time you may need to adjust your budget for many reasons such as:

- Getting married

- A financial goal has been met

- A job loss

It is fine to make adjustments, but be careful not to sway too far off course from your priories. Keep records of old budgets and take notes as to why you budgeted the way you did.

Reduce Expenses

There are many other simple ways to reduce your expenses, such as:

| Use public transportation / Carpool | Unplug unused electrical devices |

| Keep the tires of your car properly inflated | Cook (and pack) your own meals at home |

| Consolidate student loans | Make your own coffee at home |

| Stop buying on credit | Buy nonperishable items in bulk |

| Sell unused items | Use a programmable thermostat |

| Reduce or eliminate cable/satellite TV service | Cancel your gym membership (exercise at home) |

| Utilize local public libraries |

There are many other ways to reduce your expenses, as explained here.

Optimize Utilities

Most utility costs are recurring and variable. You have direct control of how long the air conditioning runs, thereby affecting your electricity costs.

Something like a refrigerator, however, is constantly running. So the more you optimize its use, the lower the cost will be.

Keeping air cool requires more energy than keeping water cool. An empty refrigerator, therefor, costs more to operate than one that is full.

With that in mind, always keep your refrigerator and freezer full. Fill the empty space of your refrigerator with bottles of water. That will reduce your expenses, but also keep emergency reserve water for your disaster preparedness.

Fill the empty space of your freezer with potable ice. Aside from saving you money for refrigeration costs, potable ice provides you with options during a power outage:

- Melt the ice to drink

- Keeps the freezer colder for longer

- Move the ice (and food) to a cooler container

- If you come home and notice the ice has melted, it is a good indicator that you had a power outage when you weren’t home. Check your food for spoilage.

Consider optimizing as many appliances as you can such as your washer / dryer, ovens, water heater, etc. Here is an article with more details on this subject.

Optimize Your Home

There are opportunities to reduce your expenses, particularly if you own your home.

- Insulate your home by filling in gaps and cracks where there shouldn’t be any.

- Fix leaky faucets to reduce your water bill

- Refinance your mortgage when interest rates fall

- Bundle your insurance

- When hiring a handyman, purchase the materials yourself

- Change all lights to LED’s

- Add timers and senors to fans and lights. This is especially useful when you have kids.

- Appeal your property tax assessment

- Consolidate debts under one low-rate loan

Stop Smoking

If you smoke, stop. You already know it’s bad for your health, but it’s also bad for your wallet. Directly, a pack costs around $8.00 (in 2022) per pack, around $56 per week if you smoke a pack per day, or $2,912 per year.

Indirectly, healthcare costs for smokers are about 40% higher than non-smokers, according to the New England Journal of Medicine. Resale costs of your car, apartment, furniture, and nearly all things you come in contact with while smoking are reduced. A San Diego State University Study in 2008 showed that the asking price for smokers’ cars was about 9% lower than non-smokers’ cars. If the Blue Book value of your used car is $15,000, expect to get nearly $1,400 less than that if it smells like an ashtray.

Little Things Add Up

Small, repetitive, and often unnoticed expenses can get huge. Back to that $5 cup of coffee 5 days a week, which translates to $1,300 a year. That is fine and great if you really like coffee, as long as you are aware of where your money is actually going.

If you have other “small” habits like these, then it can really add up.

If you still love your coffee habit and wanted to reduce your expenses, maybe it’s time to invest in a home coffee maker instead of buying individual brews. For example, if it costs $500 for a superb coffee maker, and it costs $0.50 to make each cup, your first year will cost you $630, and subsequent years will only cost you $130. That is an annual savings of $1,170.

Reduce Taxes

We cannot discuss expenses without mentioning taxes, of course! There is a myriad of ways to reduce your income tax liability which you should consult your tax advisor or CPA, but here are a few tips according to US News :

- Increase retirement account contribution – this may defer or postpone your income tax liability to your retirement years, when you may be making less money, thereby reducing your liability. This also helps you directly, of course, by preparing you for your retirement. Start contributing as early as possible, since the long-term growth is usually dependent on the length of time you are invested.

- Contribute to a health savings account (HSA) – This is good, especially if you have a plan with a high deductible. The unused contributions can roll over indefinitely and grow tax-free.

- Non-Reimbursed vehicle expenses – regular travel from your home to work and back cannot be deducted as commuting costs. You may, however, deduct costs if you use your own vehicle to travel to satellite offices or other official business sites. Make sure to keep track of your mileage.

- Earned Income Tax Credit – can lower the overall tax bill for low to moderate-income families.

- If you are looking for a job in the same field, you may deduct all related expenses as miscellaneous expenses if you itemize, while passing a 2 % threshold, even if you did not find a new job.

- Most charitable donations made by deducting your payroll can be deducted, as well as cash donations to other charitable organizations.

- Lifetime Learning Credit – Get credit for money spent on education for adults after high-school, up to $2,000 per year. Helps pay for college and training to improve your job skills.

Get more educated on this subject, since your tax preparer may overlook deductions that may apply to you. This is just one of many places to start.

Automation

Automating your finance, even in part, is a great way to keep on a budget. Think of automation as a tool to exercise financial discipline.

Most credit card companies and bank accounts have automated features that are easy and free to utilize. Services such as automatic bill payments and automatic transfers to savings/investment accounts are predicable to help you stay on budget.

It is easy to remember your monthly rent is due because, well, it comes once every month. It is not so easy to remember your auto insurance bill that comes every six months. Before you realize it, six months go by, and you are faced with a $600 bill. Instead of scrambling to find the extra cash, automatically transfer $100 every month into your savings account. When the next bill arrives, no sweat.

Enroll in an automatic 401k contribution through your employer. This way you:

- Automatically invest for your future

- Won’t be tempted to spend that money

- Reduce tax liability

Borrowing Money

“A bank is a place that will lend you money if you can prove that you don’t need it.”

Bob Hope

The first concept to understand is that borrowing is rarely free. “Rarely” because sometimes it really is free to borrow on credit in certain situations (e.g., when purchasing some brands of new cars or new appliances).

Purchasing using a credit card is also free, but only for one month. The rest of the time, the cost is called interest.

When It is Good

- Buying something that appreciates in value – A home, often one’s first large purchase, is often considered a good investment since its value may go up with time. Although the value can depreciate too, it provides you and your family with shelter.

- Buying something large – The second large purchase is an automobile. The average price of a new car in 2014 in the US was $32,086 and $16,025 for a used one. Since most people don’t have the cash on hand to purchase one, borrowing money may become a necessity.

- You find a better interest rate – If you already have a loan, do not hesitate to shop for a better one. With time, the interest rates change, and your credit rating may change, and you may be spending more money than you need to. A $100,000, ten-year loan at 4.50% interest costs you $1,036 per month, and a total of $24,366 in interest. If you reduce the interest percent by just 0.50%, it would cost you $1,012 per month, but save you $2,872 (almost 12% savings) in interest costs. Shop around!

- You have good credit – In order to be a better borrower and take advantage of lower interest deals, maintain your credit. More info on this in a later section.

- When investing in yourself – Getting a college degree, investing in a business, or anything else that has the potential to grow your future earnings potential

- Credit cards – It is good to purchase with credit cards ONLY when paying off in full every single month. If you do not have the cash to back up the purchase, skip it. Credit cards can help you build financial credit, earn points / cash back, purchase protections, etc.

When It is Bad

- You cannot afford the payments – seems simple at first, but a lot of borrowers get duped when getting an adjustable-rate mortgage. Borrowers who were caught off guard defaulted on their loans when the time came to increase rates prior to the housing bubble pop in 2008.

- You don’t have a Rainy Day Fund – If you don’t have any cash reserves, it is unwise to accumulate debt since even one missed payment can severely impact your credit or possibly face repossessions or evictions.

- When you don’t need to – Why pay more for something if you don’t have to? Unless it is necessary to purchase right now… save up and get what you need later.

- If you cannot understand the terms of the loan – If you blindly sign a contract that obligates you to pay creditors a certain amount of money, you are responsible for any breach of the agreement. Get help from a friend who has experience with loans, or consult a financial advisor prior to signing. If you sign and then back out, there could be steep financial and credit penalties associated with it.

- Credit cards – If you do not pay in full every month, the astronomic interest rates will begin to bury you financially.

Net Income

Gross Income – Expenses = Net Income

After you earned your money, paid all your tiered expenses, what should you do with the rest? Before answering that, keep this in mind that you do not have to spend it all.

- Go have some fun

- Save for a large vacation

- Try a new investment

- Stash some money away for emergencies

You may also use the remainder of the net income to pay debts faster with extra principle payments on your loans. If you do this regularly (which is a positive habit to have), loans will be paid faster and will be cheaper. Play around with this additional payment calculator so see the difference.

Conclusion

Financially preparing for disasters and emergencies is a subset of good monetary habits. Since it is far more difficult to prepare for a disaster without first standing on solid financial ground, take the time to learn the fundamentals.

Forming good financial habits will benefit you in a multitude of ways, but you must start sooner rather than later.

A future article is in the works which will focus specifically on preparing your money solely in the context of disaster / emergency preparedness.

0 Comments